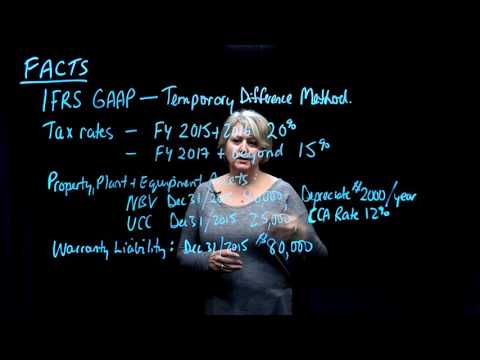

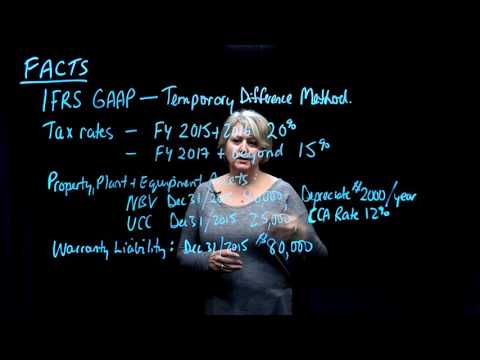

所得税の会計(IFRS)|事例紹介 - パート1/4 (Income Tax Accounting (IFRS) | Example Facts - Part 1 of 4)

陳虹如 が 2021 年 01 月 14 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありませんUS /ˈrɛləvənt/

・

UK /ˈreləvənt/

- v.t.(人を騙すために)ふりをする : 装う;仮定する : 推測する;(責任 : 任務などを)負う : 引き受ける

US /ˌsɪtʃuˈeʃən/

・

UK /ˌsɪtʃuˈeɪʃn/

- n. (c./u.)グロス(単位 : 1グロスは12ダース);合計;総重量

- v.t.総収益をあげる

- adj.気持ち悪い;総計の;下品な

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除