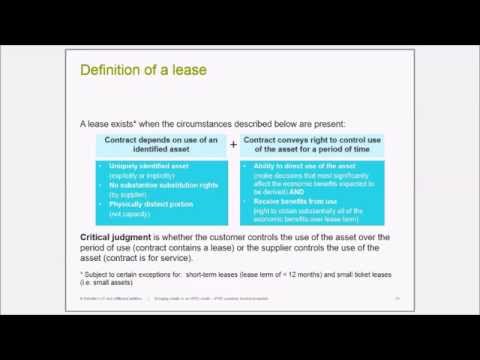

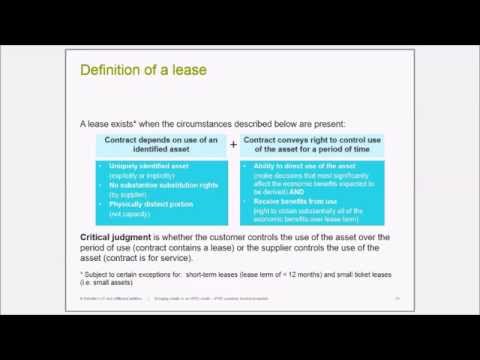

Q2 2015 IFRS四半期テクニカルアップデート - IFRSの世界に明快さをもたらす (Q2 2015 IFRS quarterly technical update - Bringing clarity to an IFRS world)

陳虹如 が 2021 年 01 月 14 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありませんUS /ˈrek.əɡ.naɪz/

・

UK /ˈrek.əɡ.naɪz/

- v.t.(~が本当であると)認める : 受け入れる;(重要性を)認める;法的権威を尊重する;公にその人の貢献を称賛する;認識する、認知する

US /sɪɡˈnɪfɪkənt/

・

UK /sɪgˈnɪfɪkənt/

US /ˈpɪriəd/

・

UK /ˈpɪəriəd/

- n. (c./u.)期間 : 時代;強調;終止符;生理;授業時間 : 時限

US /ˈprɛznt/

・

UK /'preznt/

- adj.出席している;現在

- n.プレゼント;現在時制;現在;贈り物

- v.t.紹介する;司会をする;発表する;提示する;(賞を)贈呈する

- v.i.現れる

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除