字幕と単語

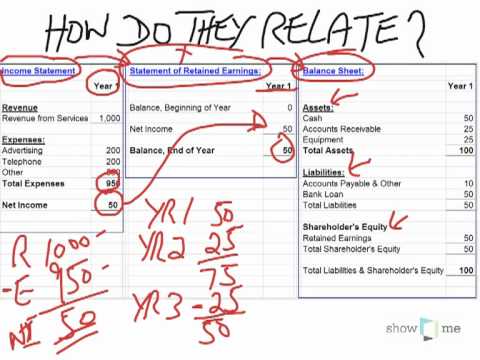

損益計算書と貸借対照表の関係 (Income statement and balance sheet relationship)

00

陳虹如 が 2021 年 01 月 14 日 に投稿保存

動画の中の単語

assume

US /əˈsum/

・

UK /ə'sju:m/

- v.t.(人を騙すために)ふりをする : 装う;仮定する : 推測する;(責任 : 任務などを)負う : 引き受ける

A2 初級TOEIC

もっと見る エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除