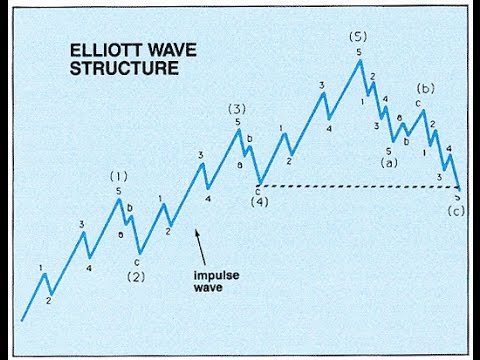

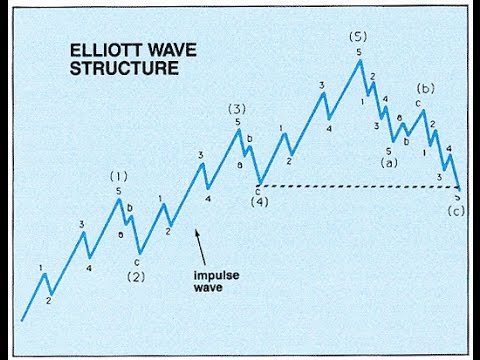

エリオット波動理論とは? (What is The Elliott Wave Theory?)

richardwang が 2021 年 01 月 14 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありません- n. (c./u.)単語 : 語;約束;伝言 : 知らせ

- v.t.言葉で言い表す

- n. (u.)話し方;会談;講演;会話

- v.i.講義する : 講演する

- v.t./i.話す

- n. (c./u.)(24時間の)一日;(朝から夕方までの)日中;デイ

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除