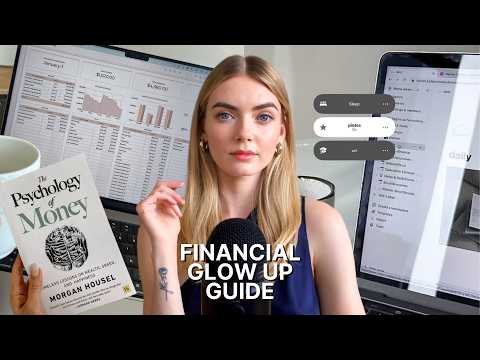

あなたのお金が輝きだす:20代の予算管理、貯蓄、資産形成 ? (Your Money Glow Up: Budgeting, Saving & Building Wealth in Your 20’s ?)

chu592855 が 2024 年 11 月 26 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありませんUS /ˈkruʃəl/

・

UK /'kru:ʃl/

- v.t./i.突き刺す : 刺し込む;貼る : くっつける;とどまる;突き出す;我慢する

- n. (c.)棒

- v.t./i.出場する;計算する;思う;思う

- n.姿 : 体形;数字;人物像;図表;著名人;姿の輪郭;数字

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除