字幕と単語

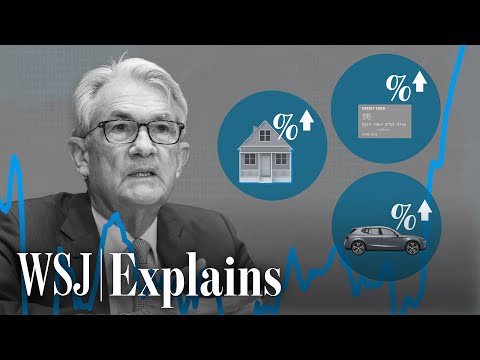

How the Fed Steers Interest Rates to Guide the Entire Economy | WSJ

00

許立緯 が 2022 年 04 月 02 日 に投稿保存

動画の中の単語

potential

US /pəˈtɛnʃəl/

・

UK /pəˈtenʃl/

- adj.可能性がある;潜在的な

- n. (u.)可能性

- n. (c./u.)可能性;潜在能力;候補者;ポテンシャル

A2 初級TOEIC

もっと見る エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除