字幕と単語

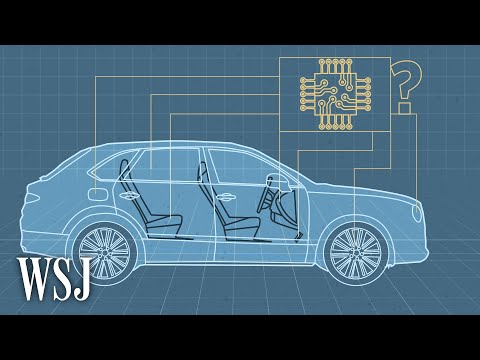

How the Chip Shortage Is Forcing Auto Makers to Adapt | WSJ

00

joey joey が 2021 年 09 月 18 日 に投稿保存

動画の中の単語

individual

US /ˌɪndəˈvɪdʒuəl/

・

UK /ˌɪndɪˈvɪdʒuəl/

- n. (c.)個人;個々の項目;個体;個人競技

- adj.個人用の;個人の;個々の;独特の

A2 初級

もっと見る エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除