字幕と単語

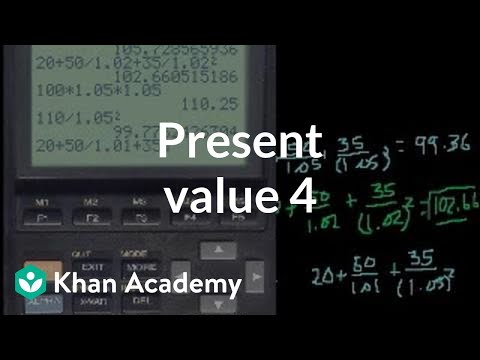

現在価値4(および割引キャッシュフロー (Present Value 4 (and discounted cash flow))

00

kellylin007 が 2021 年 01 月 14 日 に投稿保存

動画の中の単語

present

US /ˈprɛznt/

・

UK /'preznt/

- adj.出席している;現在

- n.プレゼント;現在時制;現在;贈り物

- v.t.紹介する;司会をする;発表する;提示する;(賞を)贈呈する

- v.i.現れる

A1 初級TOEIC

もっと見る エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除