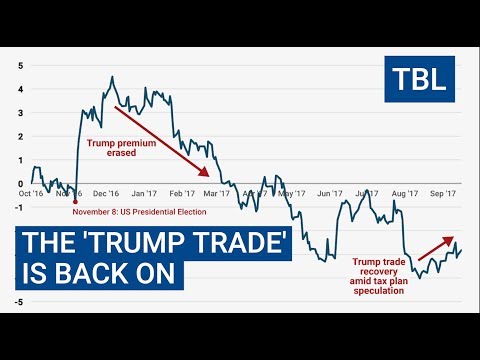

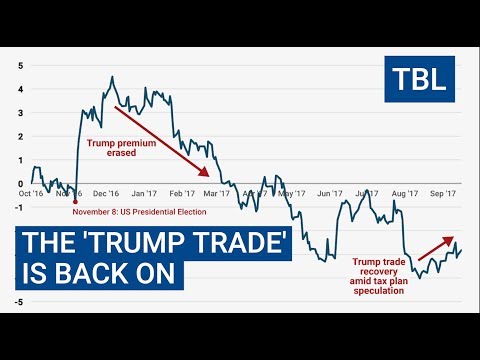

トレーダーはトランプ氏の減税計画に向けて準備を進めている (Traders are gearing up for Trump's tax cut plan)

jenny が 2021 年 01 月 14 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありませんUS /ˌɑpɚˈtunɪti, -ˈtju-/

・

UK /ˌɒpə'tju:nətɪ/

- n. (c./u.)機会;好機;仕事の機会;ビジネスチャンス

US /ˈmʌltəpəl/

・

UK /ˈmʌltɪpl/

- adj.複数の;多様な;多発性の;多重の

- n. (c.)倍数;多数;倍率

- pron.多数

US /ˈstrætədʒi/

・

UK /'strætədʒɪ/

- n. (c./u.)条件;期間;学期;用語;関係;項;妊娠期間;任期

- v.t.称する

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除