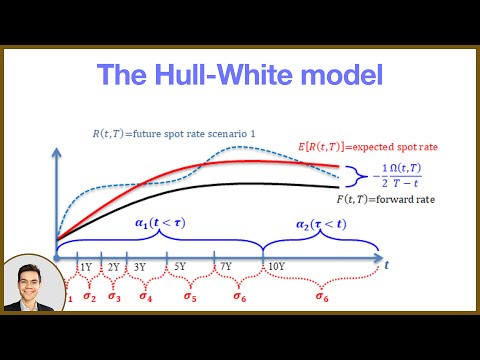

ハル・ホワイト・モデル (The Hull-White model)

gallon が 2024 年 08 月 31 日 に投稿  この条件に一致する単語はありません

この条件に一致する単語はありませんUS /ˈʌltəmɪtli/

・

UK /ˈʌltɪmətli/

US /ɪˈsenʃəli/

・

UK /ɪˈsenʃəli/

US /əˈprəʊtʃ/

・

UK /ə'prəʊtʃ/

- v.t./i.近づく;話を持ちかける

- n. (c./u.)目的に近づく方法 : 道;交渉しようとして人に近づくこと;取り組み方 : 扱い方

エネルギーを使用

すべての単語を解除

発音・解説・フィルター機能を解除